Establish, change, or stop an allotment to an organizationAs the debt was handed over to a collections agency well after the fact meaning for example never being late with payment but at one point after a financial crisis from divorce entered into a 3 plus year contract to consolidateDocumenting transactions or income for legal proceedings;

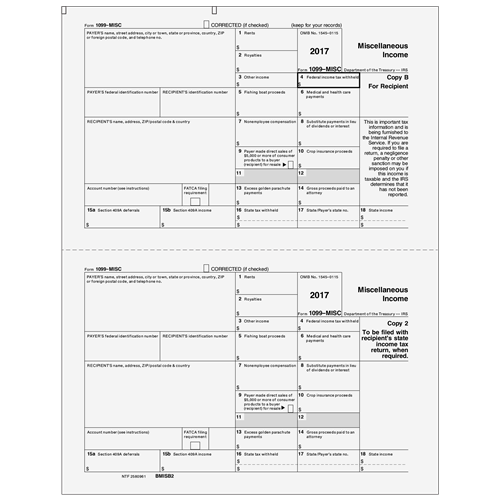

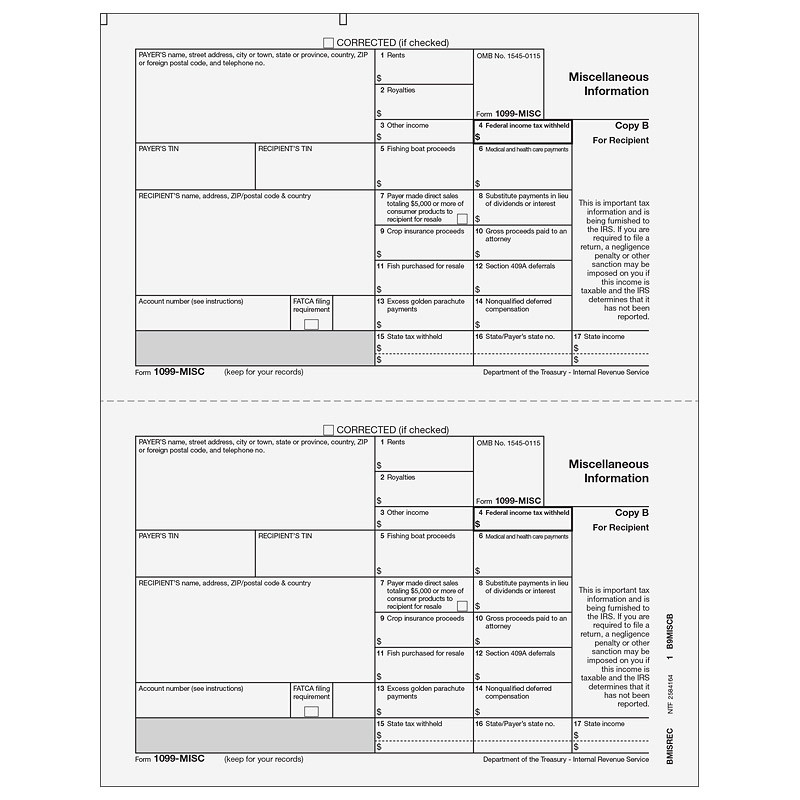

1099 Misc Recipient Copy B Laser Forms

1099 copy

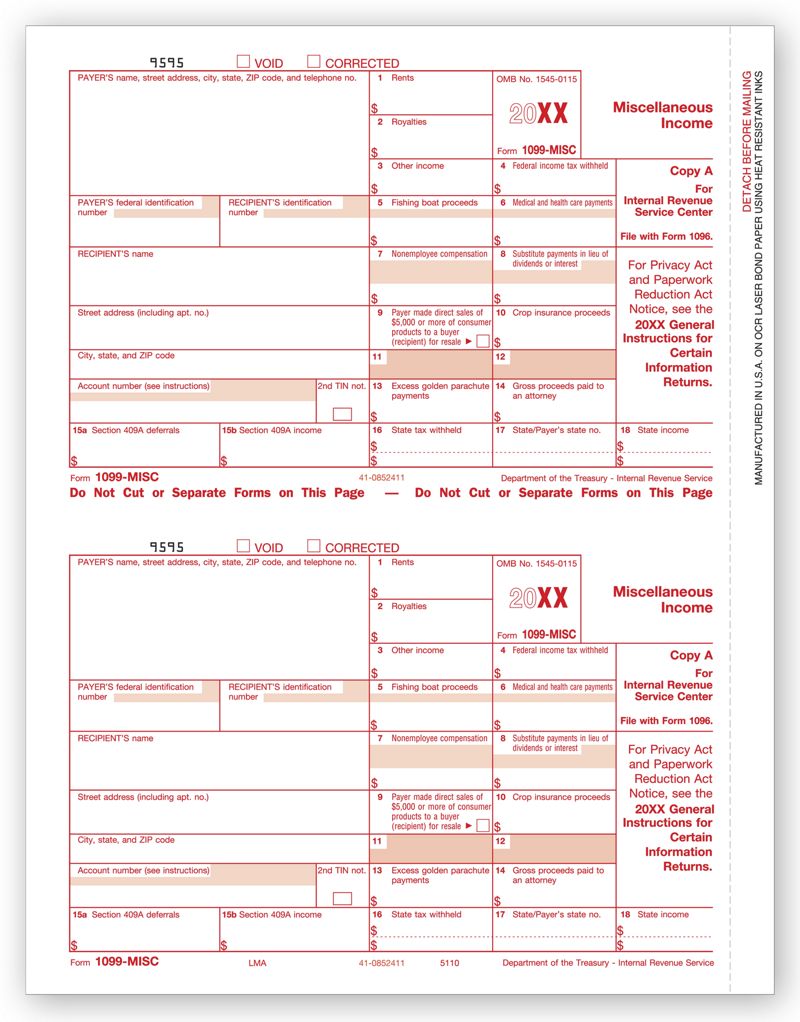

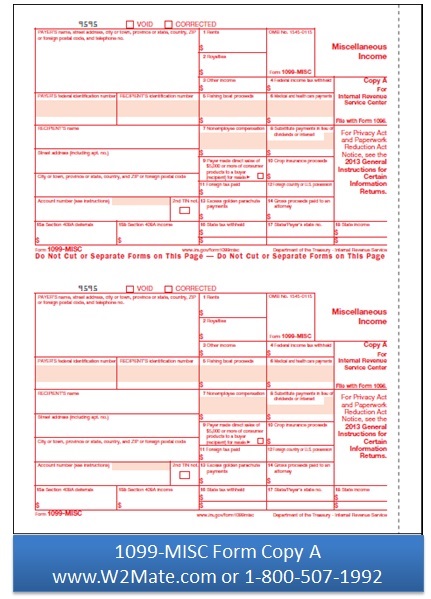

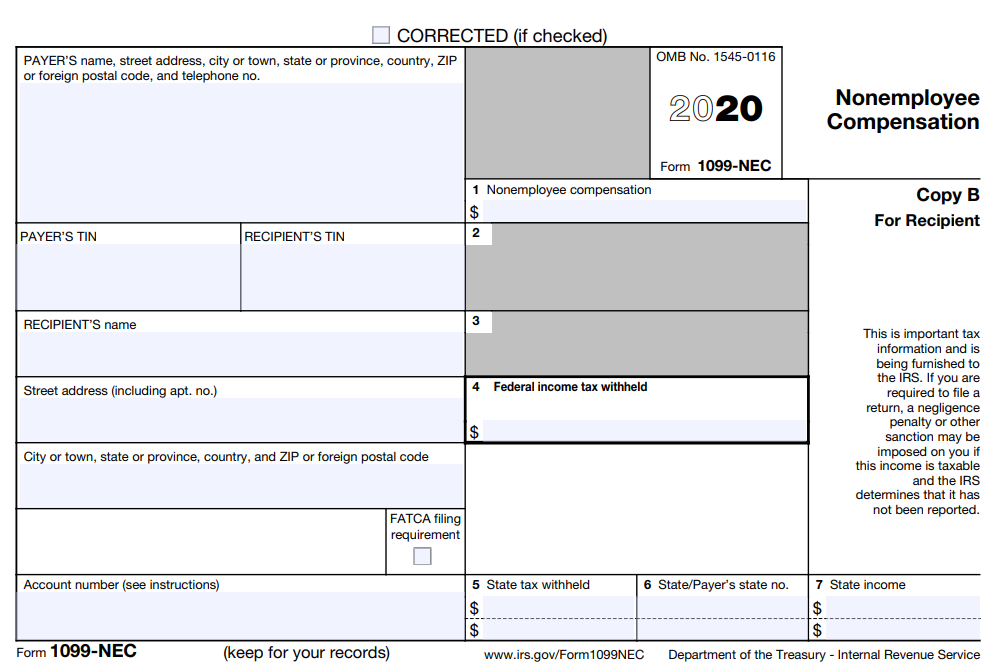

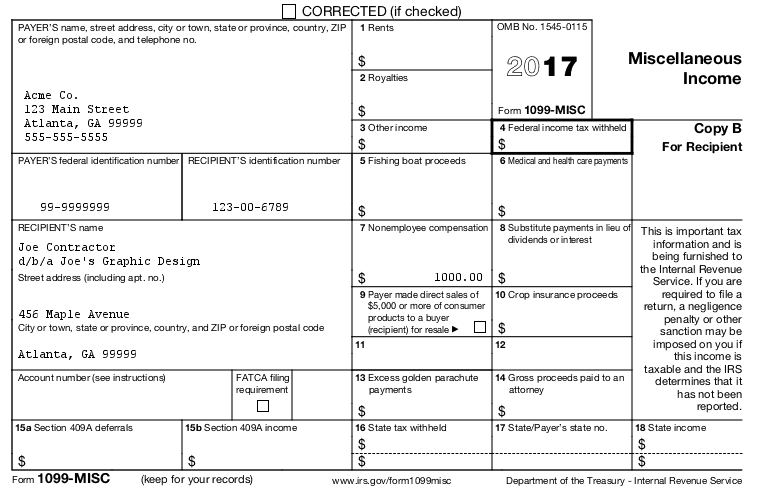

1099 copy-Official 1099MISC Form Copy A for Filing with the IRS Send this redscannable 1099MISC Copy A form to the IRS to report miscellaneous payments of $600 that are NOT for nonemployee compensation For payments to freelancers, contractors, attorneys, etc, you need 1099NEC forms POSSIBLE NEW EFILING REQUIREMENTS FOR 215011 NEC 1099 Laser Recp Copy B The NEW 1099NEC form is used for reporting nonemployee compensation, previously in box 7 of the 1099MISC form More Details;

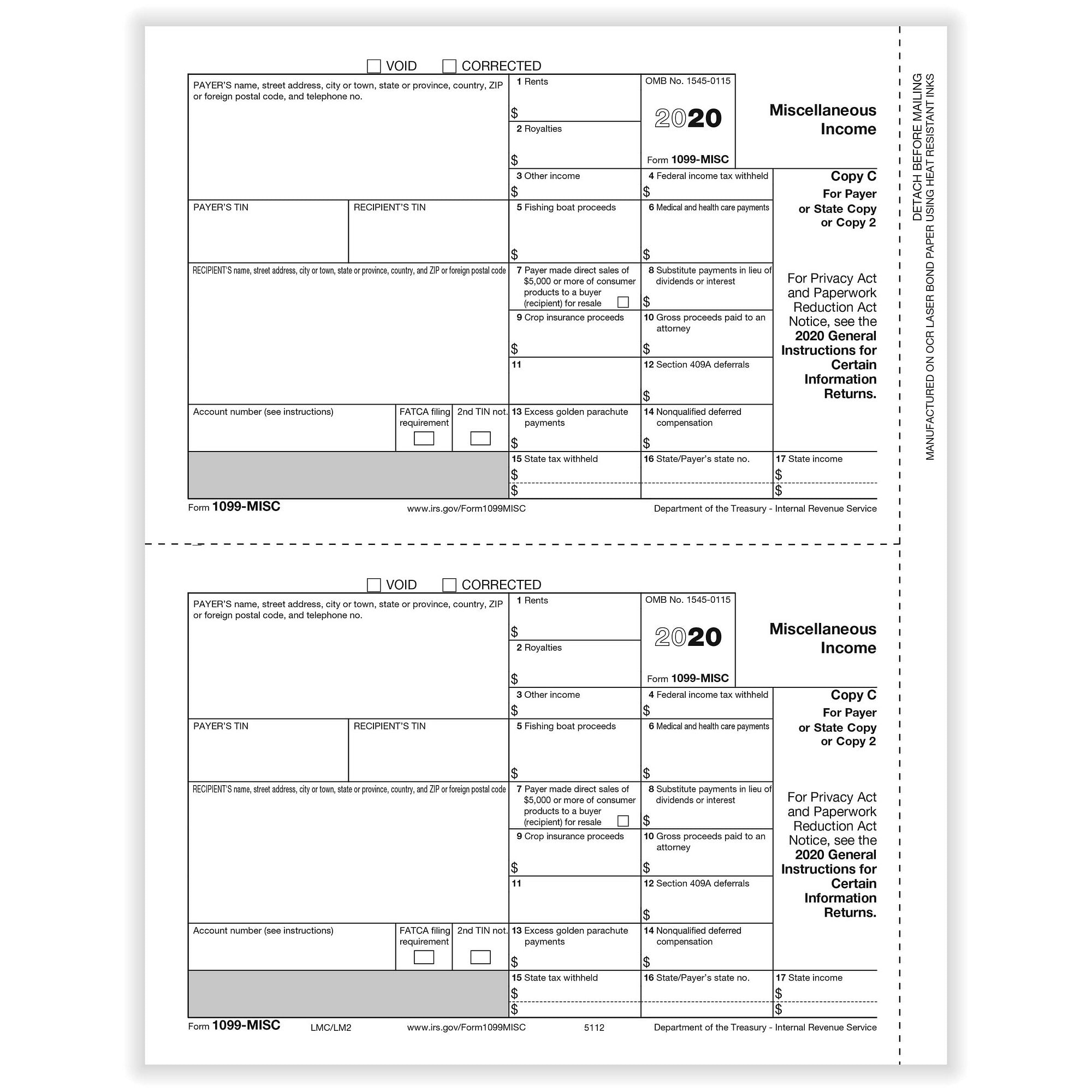

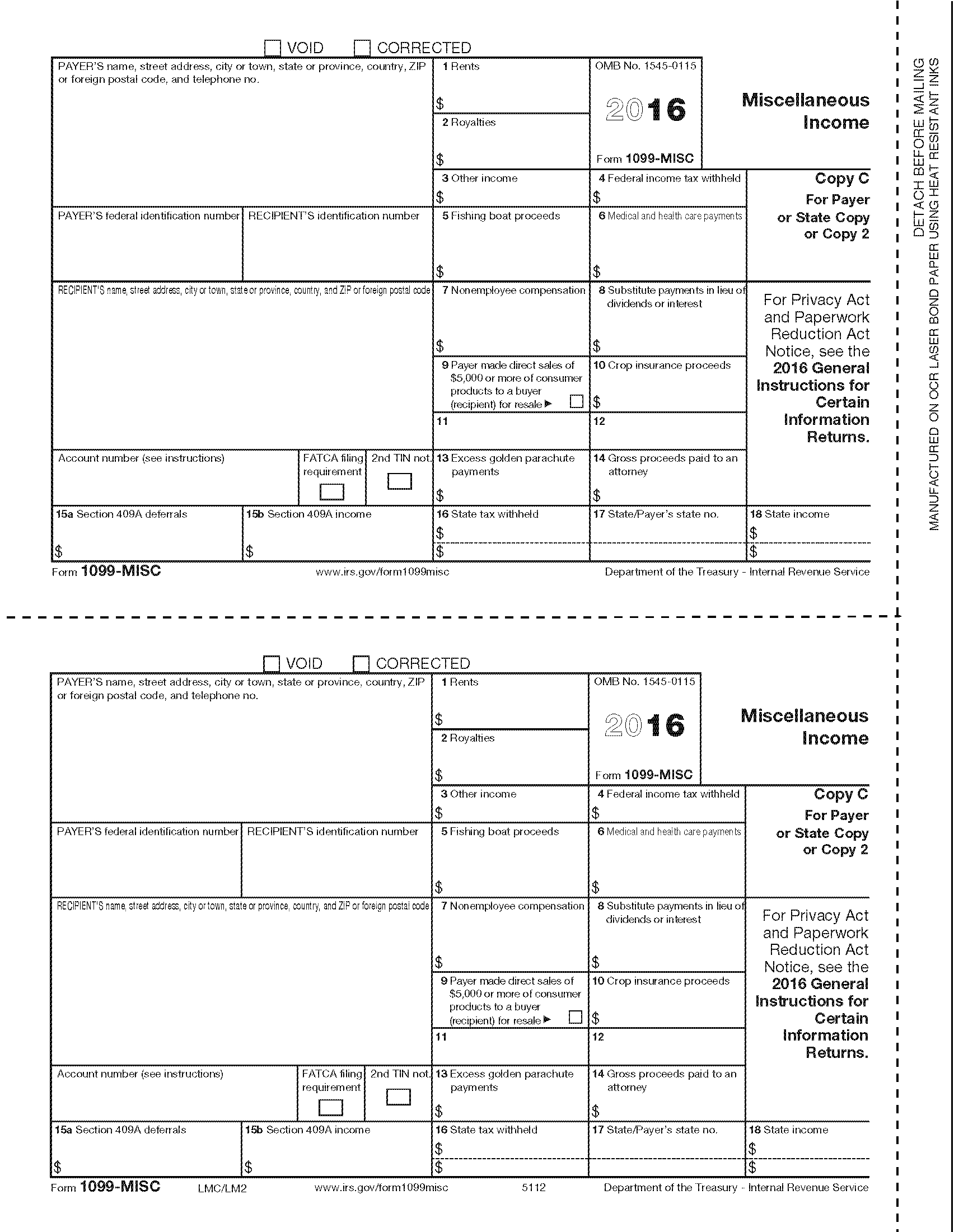

Form 1099 Misc Miscellaneous Income Payer State Copy C

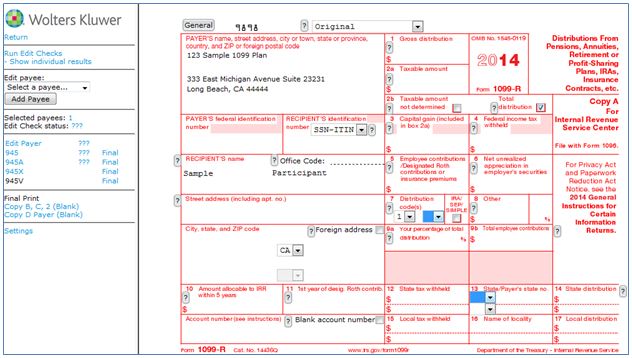

Copy 1 is for the state tax department and Copy 2 is for submission with the recipient's state income taxes, where applicable Copy C, on the other hand, is the employer's to keep on file Make sure you keep a copy of every 1099 you file each year in the event your business is ever audited by the IRS Advertisement1099A 21 Acquisition or Abandonment of Secured Property Copy B For Borrower Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transactionRequest a duplicate taxfiling statement (1099R);

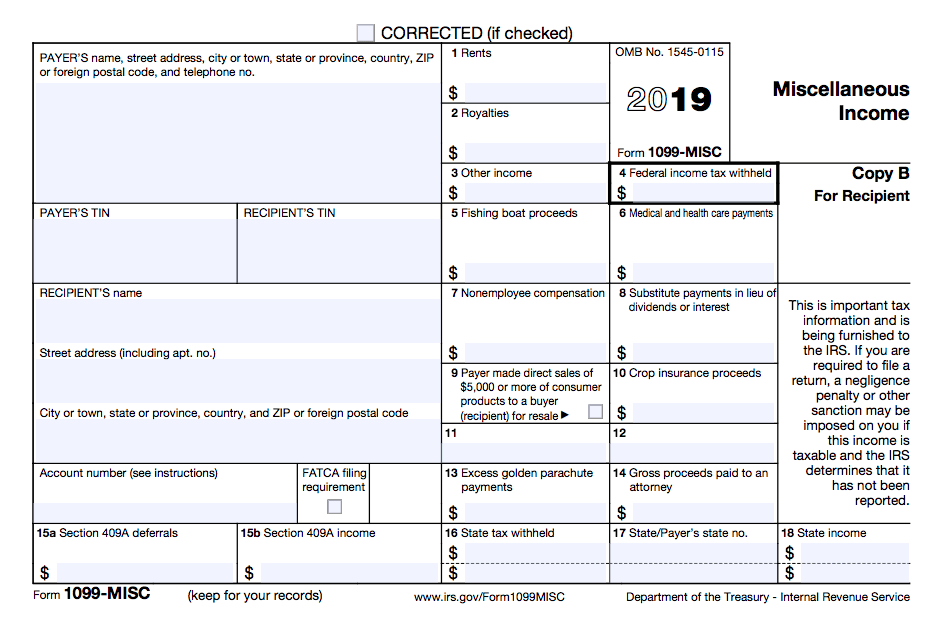

Where is COPY A of my Forms 1099 and W2?What if you cannot recall the sender of this form?1099MISC 19 Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 19 General Instructions for Certain Information Returns 9595 VOID CORRECTED

If you file a physical copy of Form 1099NEC, Copy A to the IRS, you also need to complete and file Form 1096 The IRS uses Form 1096 to track every physical 1099 you are filing for the year The deadline for Form 1096 is 5 Check if you need to submit 1099 forms with your stateForm 1099G tax information is available for up to five years through UI Online Note If an adjustment was made to your Form 1099G, it will not be available online Call , Monday through Friday, from 8 am to 5 pm (Pacific time), except on state holidays Request a Copy of Your Form 1099GApplying for loans or benefits;

1099 Misc Miscellaneous Payer State Copy C Cut Sheet 400 Forms Pack

21 Laser 1099 Misc Income Federal Copy A Deluxe Com

Identifying where you had bank or retirement accounts;Inst 1099MISC and 1099NEC Instructions for Forms 1099MISC and 1099NEC, Miscellaneous Income and Nonemployee Compensation 21 Form 1099MISC Miscellaneous Income (Info Copy Only) 21 Form 1099MISC Miscellaneous Income (Info Copy Only) If you had more than $600 worth of debt canceled, the creditor will typically file this form with the IRS, and you will receive a copy You may have a tax bill related to the amount forgiven 1099

Sample 1099 Misc Forms Printed Ezw2 Software

1099 Nec Form Copy B Recipient Zbp Forms

Form 1099NEC, Nonemployee Compensation, is a form that solely reports nonemployee compensation Form 1099NEC is not a replacement for Form 1099MISC Form 1099NEC is only replacing the use of Form 1099MISC for reporting independent contractor payments And, the 1099NEC is actually not a new form It was last used in 19You likely need a different 1099 form this year If you have used 1099MISC form to report payments to contractors, freelancers or for any type of nonemployeeHow do I get a copy of my 1099R?

Sample 1099 Misc Forms Printed Ezw2 Software

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

The 1099G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year, January 1 to December 31 Every year, we send a 1099G to people who received unemployment benefits We also send this information to the IRS Form 1099MISC is the most common type of 1099 form Companies use it to report income earned by people who work as independent contractors rather than regular payroll employees The IRS requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor so that the IRS can predict how much The 1099 correction form is the same as the original form You must use a regular copy of Form 1099 (either NEC or MISC) and mark the box next to "CORRECTED" at the top Send corrected Forms 1099 to the IRS, contractor or vendor, and state agencies (if applicable) And, be ready to file a corrected Form 1096 to accompany the return you're

1099misc Filing Forms Software E File Zbpforms Com

1099 Misc Forms Set Zbp Forms

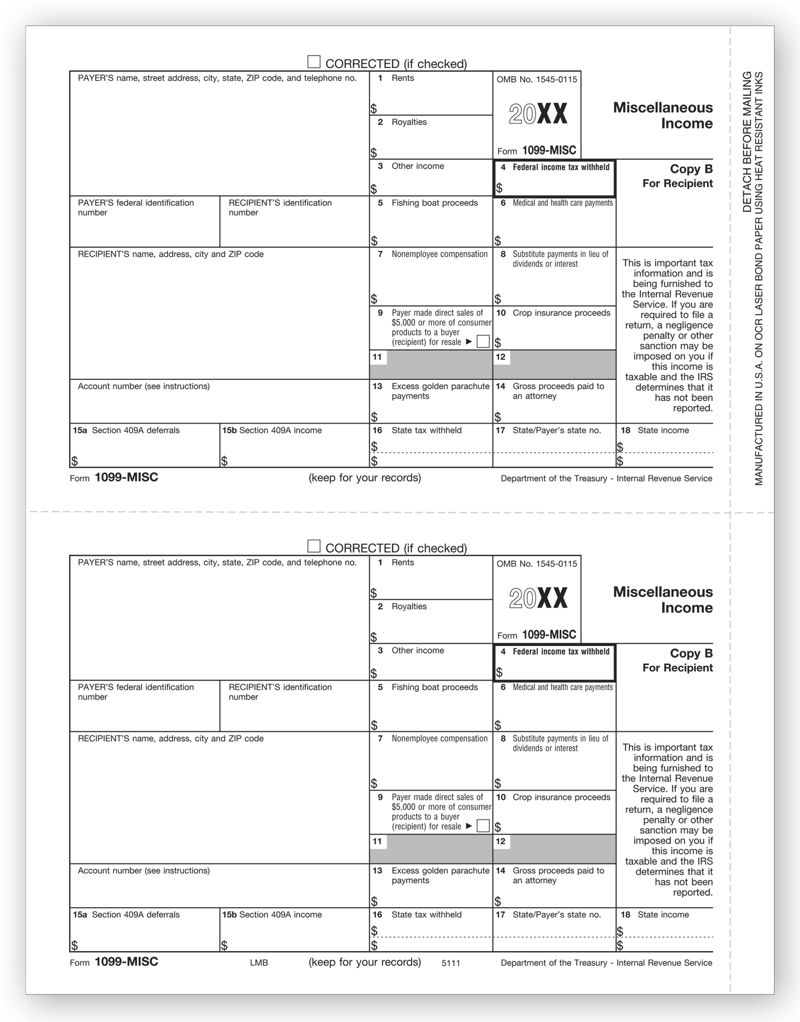

1099MISC Form Copy B Recipient ZBP Forms Official 1099MISC Forms for Recipients Use the 1099MISC form Copy B for the recipient to file with their Federal tax return STOP!Use Services Online (Retirement Services) to start, change, or stop Federal and State income tax withholdings;Form 1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service

Form 1099 Misc Miscellaneous Income Payer State Copy C

21 Laser 1099 Misc Income Recipient Copy B Deluxe Com

If you borrowed money from a lender and at least $600 of that debt was canceled or forgiven, you should receive Form 1099C from the lender (the IRS also receives a copy Form 1099MISC can be filed with the IRS on paper if you have 250 or fewer forms However, the electronic filing of Form 1099MISC is always preferable as it is both comfortable and costeffective If you are filing on paper, use Copy A For electronically filing 1099MISC, visit eFile360 efiling service Forms 1099 are provided by the payer to the IRS, with a copy sent to the recipient of the payments These forms alert the IRS that this money has changed hands Taxpayers generally don't have to file their 1099s with the IRS because the IRS already has the form, but they do have to report the income on their tax returns

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

Product Details 1099MISC Tax Forms – Recipient Copy B Copy B forms for payers to mail to the recipient Use 1099 Miscellaneous Forms to report miscellaneous payment of $600 that are NOT NonEmployee Compensation (use 1099NEC forms to report payments to freelancers, contractors, attorneys, etc) Order a quantity equal to the number of recipients you have If you need a complete photocopy of a pastyear tax return, which includes your 1099 information, complete Form 4506T, "Request for Copy of Tax Return," attach payment and mail it to the IRS at the address listed on the form Download this form from the IRS website By phone Call the IRS at to request a copy of the form to beForm 1099A Acquisition or Abandonment of Secured Property (Info Copy Only) 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Form 1099B

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Do You Need To Issue A 1099 To Your Vendors Accountingprose

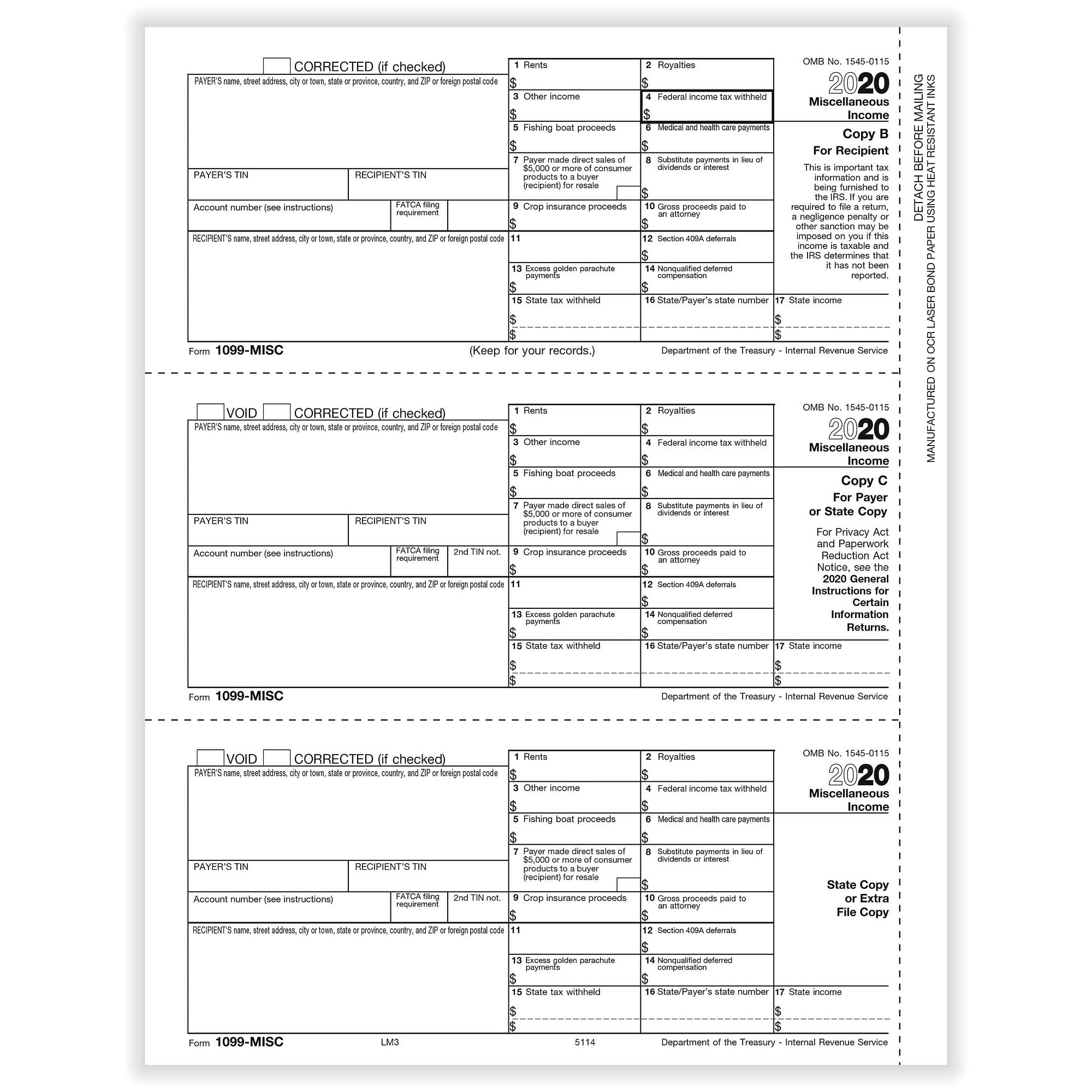

After you've submitted the 1099's or W2's forms electronically, you'll be able to view and generate a copy in your QuickBooks Online (QBO) account You can follow the steps mentioned by @FritzF, so you can print a copy of your 1099's On the other hand, for W2 forms, we include the W3 information in the electronic file To generate a copy of W3 1099MISC Tax Forms – Payer State or File Copy C/2 1099MISC Copy C2 forms for payers to mail to the state and keep a copy for their records Use 1099 Miscellaneous Forms to report miscellaneous payment of $600 that are NOT NonEmployee Compensation (use 1099NEC forms to report payments to freelancers, contractors, attorneys, etc)1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1

Change your Personal Identification Number (PIN) for accessing our automated systems; Is there a way to obtain a copy of a 1099C if I misplaced it?1099R Forms for were recently mailed to retirees Please allow up to two weeks for delivery of your 1099R Your 1099R can be accessed immediately by logging in to myLASERSorg and clicking on Documents Duplicate 1099R documents can be printed from myLASERS as well

1099 Misc Federal Copy A 1099 Forms

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Form 1099MISC Miscellaneous Income (Info Copy Only) Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income 19 Inst 1099MISC and 1099Tracing your income history;1099MISC Form – Copy A for Federal 1099 Miscellaneous Income Reporting of $600 **IMPORTANT CHANGES** If you use this form to report nonemployee compensation in Box 7, you MUST USE NEW 1099NEC FORMS in Learn more > If you file more than 100 forms, you MUST EFILE with the IRS in Our Discount Efile System makes it easy to do online!

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Form 1099 Misc 2up Miscellaneous Income Recipient Copies B 2 Bmisb5

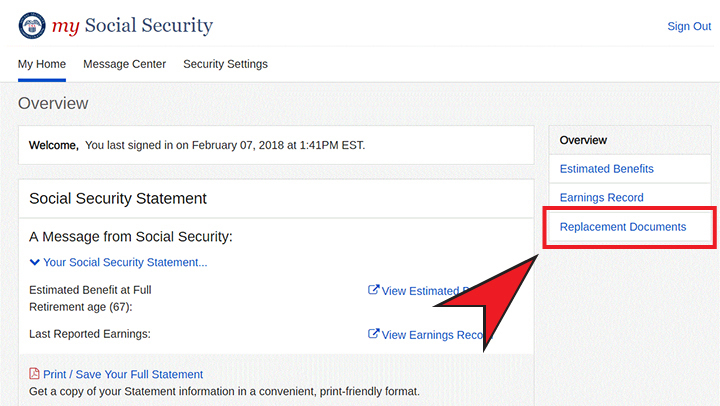

Priced Per Quantity (Forms) Minimum 50; The Benefit Statement is also known as the SSA1099 or the SSA1042S Now you can get a copy of your 1099 anytime and anywhere you want using our online services A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefitsThis is Only Copy A Two filings per sheet 13 sheets 1099 MISC Copy A Forms for IRS, (2 forms per sheet) 26 Tax recipients Government approved # bond paper Compatible with laser or inkjet printers IRS Approve = Size 8 1/2" x 11

1099 Oid Federal Copy A For 50 Recipients Office Products Human Resources Forms Femsa Com

E File Form 1099 Misc Online How To File 1099 Misc For

People often need copies of their old Forms W2 or 1099 Here are some common reasons Filing back tax returns;Get a copy of your Social Security 1099 (SSA1099) tax form online Need a replacement copy of your SSA1099 or SSA1042S, also known as a Benefit Statement? Here's how Purchase your 1099 Kit by midJanuary so you can print and mail in time for IRS filing and contractor delivery deadlines (postmark January 31) Prepare your 1099s in QuickBooks When complete, choose the Print and mail option Check if the forms align properly by selecting Print sample on blank paper

Irs Form 1099 Reporting For Small Business Owners In

Nec5112 2 Up 1099 Nec Laser Payer State Copy C Tax Form With Nec Non Employee Compensation New Form

You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account Sign in Create your accountKnow the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keeping W2 1099 Forms Filer Pricing Boxes 5, 6, and 7 The IRS doesn't require that you fill in these boxes, but your state's department of taxation might require a copy of the Form 1099NEC with this information Enter the person's state income, any state taxes you might have withheld, and identify the state or states to which you'll be reporting

Amazon Com Irs Approved 1099 Misc Copy A Bulk Discount Tax Form 1 Carton Office Products

Bmis105 1099 Misc Miscellaneous Information Payer State Copy 1 Greatland Com

Form 1099NEC has two copies Copy A and Copy B Copy A should be filed with the IRS, and Copy B should be sent directly to the contractor Any contractor you hired and paid $600 or more for services rendered in a calendar year must report those earnings Contractors receiving Copy B of 1099NEC are not required to file the said formUse Form 1099MISC Copy A to print and mail payment information to the IRS 1099MISC forms are printed in a 2up format, on 8 1/2" x 11" paper with 1/2" side perforation, and are printed on # laser paper Order by number of forms, not sheetsQuick Employer Forms only supports efiling of the forms with the IRS and Social Security Administration Copy A of the Form 1099 and W2 are only used for efiling and are not provided for printing From Quick Employer Forms FAQs

1099 Laser Misc Federal Copy A Item 5110

1099 Misc Payer State Copy 1

A copy of the first page and signature page from the last federal tax return (Form 1040, 1040A, or 1040EZ) showing that the representative and deceased claimant filed jointly or that the representative filed as a qualifying widow(er) of the deceased claimantThe IRS has them for the past 10 years – here's how to get them If you're using a 1099 employee, you will first want to create a written contract If you pay them $600 or more over the course of a year, you will need to file a 1099MISC with the IRS and send a copy to your contractor If you need help with employee classification or filing the appropriate paperwork, post your need in UpCounsel's marketplace

1099 R Recipient Federal Copy B

1099 Misc State Copy 1 Laser Forms

If you already mailed or eFiled your form 1099's to the IRS and now need to make a correction, you will need to file by paper copy a Red Copy A and 1096, fill out and mail to the IRS, if you need further assistance preparing your corrected paper copy, please contact your local tax provider or call the IRS at (800)Form 1099MISC Copies of the form Our 1099 EFile service steps you through creating, printing or emailing, and efiling copies of Form 1099MISC required by the IRS and by your state Copy A is what we transmit electronically to the IRS Don't print this copy Print Copies B and 2 and mail them to your 1099 vendor — the recipient (You can also download them and then email them) Note The paper version of Copy A of Form 1099 is for your records You shouldn't print or mail this form to the IRS Step 5 Check your filing status After you file your 1099s to the IRS with the steps above, we'll notify you of your filings' status through email You can also check your filing status anytime by in your 1099 EFile account

1099 Misc Miscellaneous Income Payer State Copy 1 2up

1

Tax Form 1099 R Copy A Federal 5140 Form Center

Tax Form 1099 Div Copy A Federal 5130 Form Center

Amazon Com Egp 1099 Misc Payer Or State Copy C Irs Approved Laser Quantity 3000 Forms Recipients 1500 Sheets 3 Cartons Office Products

Copy Of 1099

1099 Misc Form Copy B Recipient Zbp Forms

Tf5112b 2 Up 1099 Misc Laser Payer State Copy C Tax Forms In Bulk Packs

1099 Misc Miscellaneous Income Recipient State Copy 2 2up

1099 1098 5498 3 Up Blank Form Without Instructions Forms Fulfillment

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

Form 1099 Misc Miscellaneous Income Recipient Copy B

1099 Misc Tax Form Pressure Seal W 2taxforms Com

Tf5112 Laser 1099 Miscellaneous Income Payer State Copy C 8 1 2 X 11

Tax Form 1099 Misc Copy B Recipient 5111 Form Center

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Miscellaneous Income Recipient Copy B 2up

Form 1099 Nec Instructions And Tax Reporting Guide

Laser 1099 Misc Forms Bradford Business Checks

19 1099 Misc 1096 Irs Copy A Form Print Template For Word Etsy

Nec5111 2 Up Laser 1099 Nec Recipient Copy B Tax Form With Nec Non Employee Compensation New Form

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Recipient Copy B Laser Forms

Form 1099 Misc Miscellaneous Income Irs Copy A

1

What Is 1099 Misc Form How To File It Complete Guide

Tf5141 Laser 1099 R Copy B 8 1 2 X 11

1099 Misc Laser Recipients Copy B

1099 Misc Form Copy A Federal Discount Tax Forms

1099 B Form Copy A Federal Discount Tax Forms

What Is Form 1099 Nec

1099 S Form Copy B Transferor Discount Tax Forms

Tf5111 Laser 1099 Miscellaneous Income Recipient Copy B 8 1 2 X 11

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Misc Miscellaneous Income Payer Copy C 2up

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Misc Payer Copy C

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

1099 K Form Copy B Payee Discount Tax Forms

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Use Form 1099 Nec To Report Non Employee Compensation In

1099 Misc Recipient State Copy 2

1099 Misc Form Reporting Requirements Chicago Accounting Company

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

Amazon Com 1099 Misc Form Copy A 21 Federal Income Laser Form Pack Of 25 Tax Recipients Office Products

1099 Misc Laser Recipient Copy B For 21 627 Tf5111

What Is A 1099 Form And Do I Need To File One River Iron

1099 Copy A B C Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc Miscellaneous Income Payer State Copy 1

Replacement Ssa 1099 Ssa

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Software User Guide

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Nec Software Software To Create Print And E File Form 1099 Nec

1099 Misc Laser Federal Copy A

How To File 1099 Misc For Independent Contractor Checkmark Blog

1099 Misc Copy A Laser W 2taxforms Com

How To Fill Out 1099 Misc Irs Red Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Form Fillable Fill Online Printable Fillable Blank Pdffiller

1099 Misc Federal Copy A

What Is Form 1099 Nec Who Uses It What To Include More

1099 Nec Federal Copy A Cut Sheet Hrdirect

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 S Tax Form Copy A Laser W 2taxforms Com

Form 1099 Misc To Report Miscellaneous Income

Year End 1099 Misc Irs Copy Forms

Nagforms Laser 1099 Nec Payer State Copy C 100 Pk Neclmc

1099 Misc Miscellaneous 2 Up Federal Copy A Creative Document Solutions Llc

How Do You File 1099 Misc Wp1099

Tf5114b Laser 1099 Misc Income 3 Up Copy B Bulk 8 1 2 X 11

0 件のコメント:

コメントを投稿