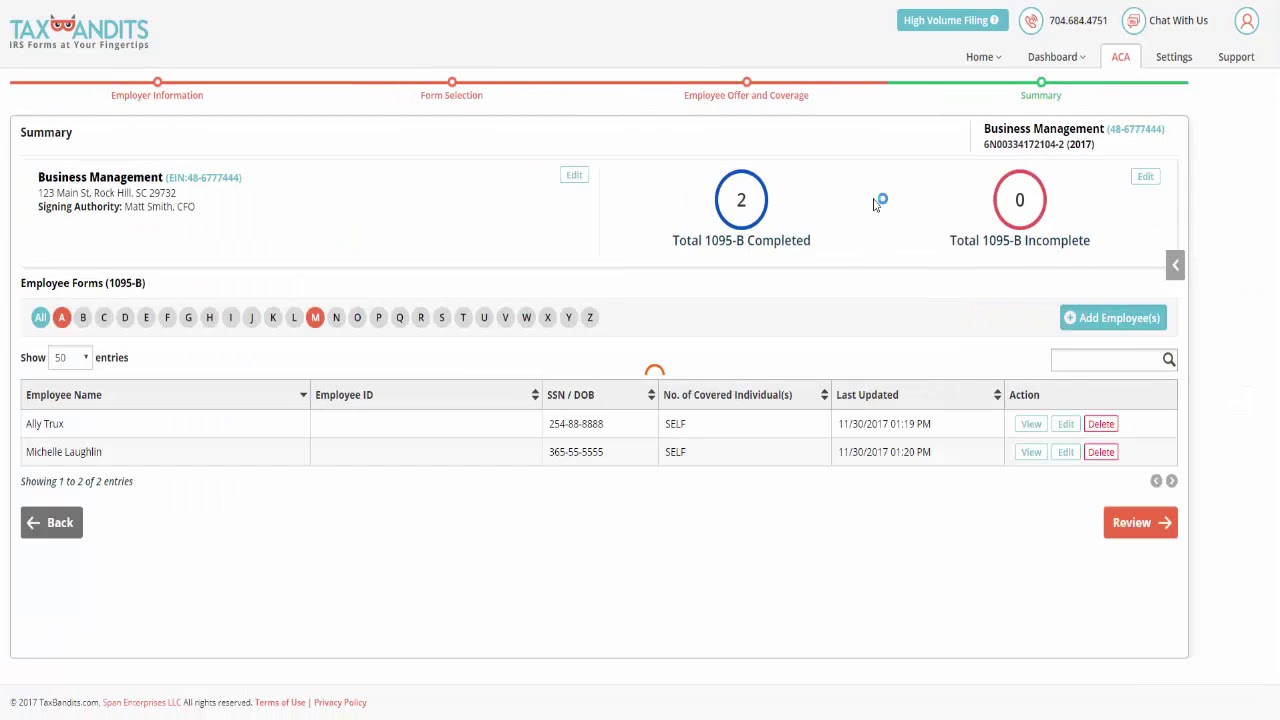

Paper filing will not be acceptedIRS Filing Deadline (eFile) affordable care act forms 1094/1095B and 1094/1095C The links below are for Tax Year forms Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year Form 1095B – Health Coverage – Tax Year Instructions for Forms 1094B and 1095BThe deadline to send forms 1095C and 1094C to the IRS on paper is , when filing electronically the due date is All data needed to fill 1095C / 1094C forms can be saved for later use and modification (forms stored for future access and corrections)

7 Must Know 21 Hr Compliance Dates Workest

1094-c filing deadline 2021

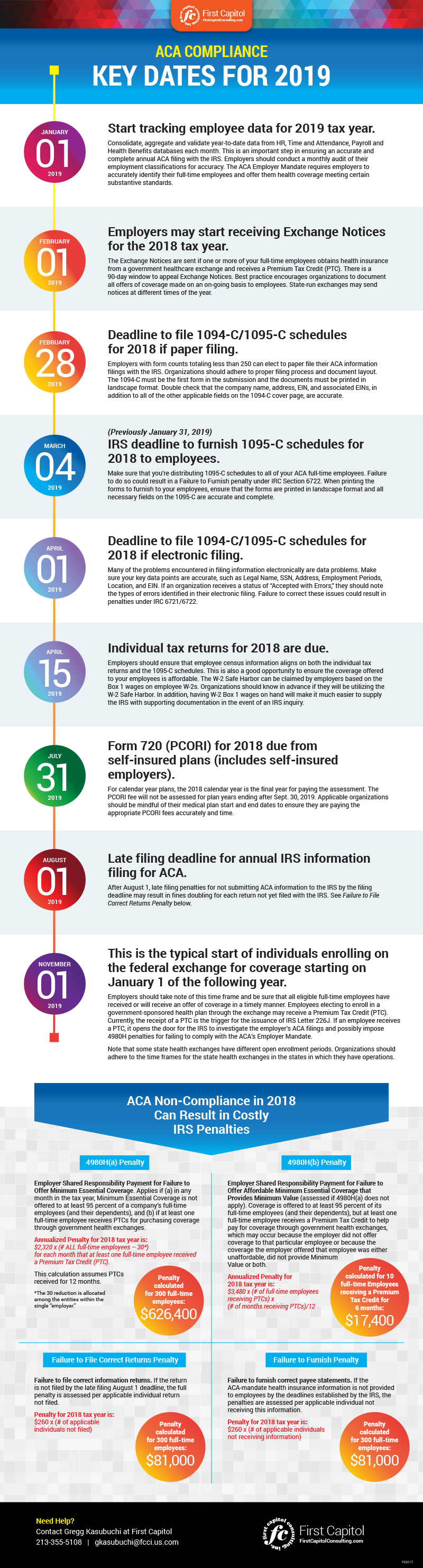

1094-c filing deadline 2021- On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21 is the deadline for large employers and employers with selffunded plans to file certain Affordable Care Act forms with the IRS (Forms 1094C, 1095C, and Forms 1095B), if the employer is filing electronically Affordable Care Act (ACA) Reporting Reporting by Applicable Large Employers (ALEs)

Employer Reporting Forms 1094 C And 1095 C Hays Companies

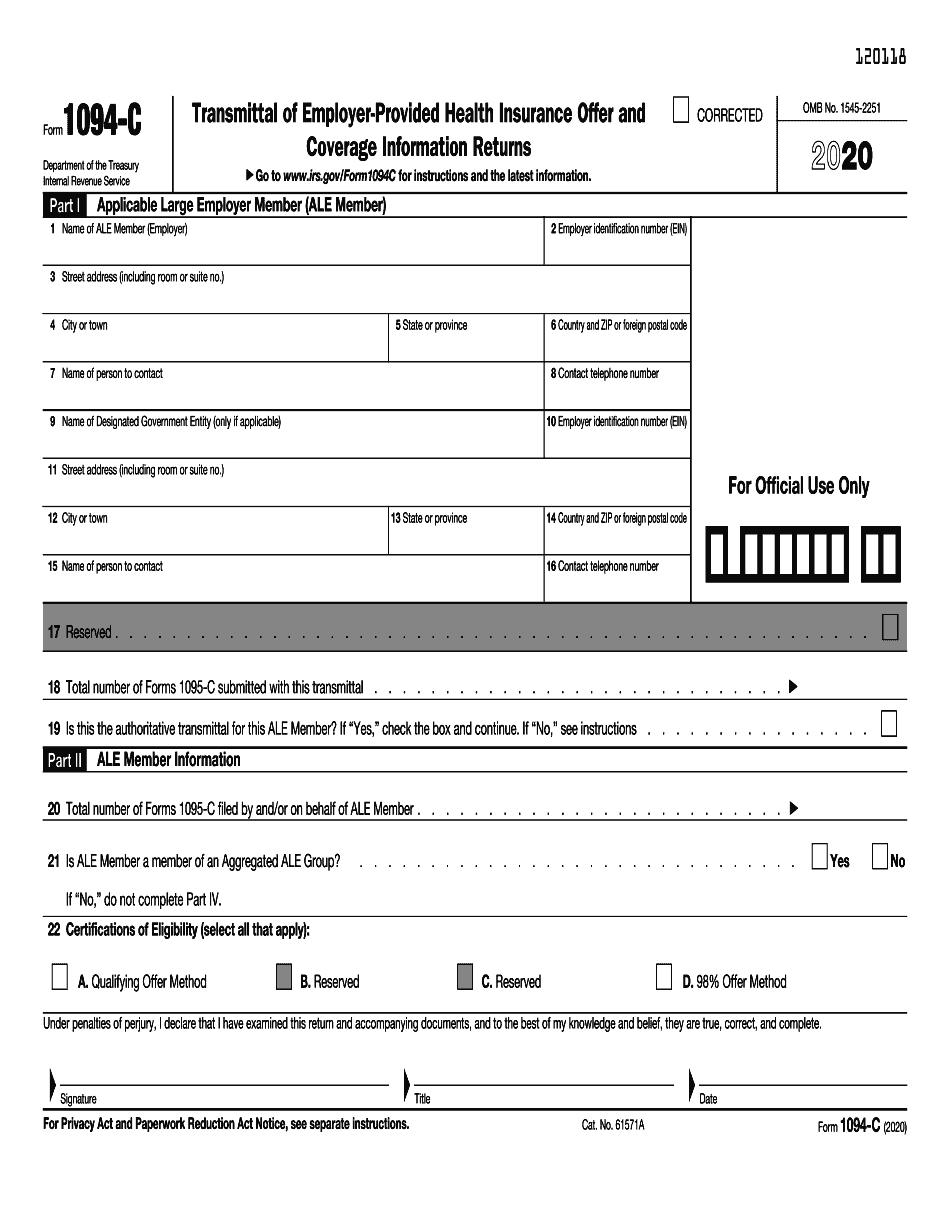

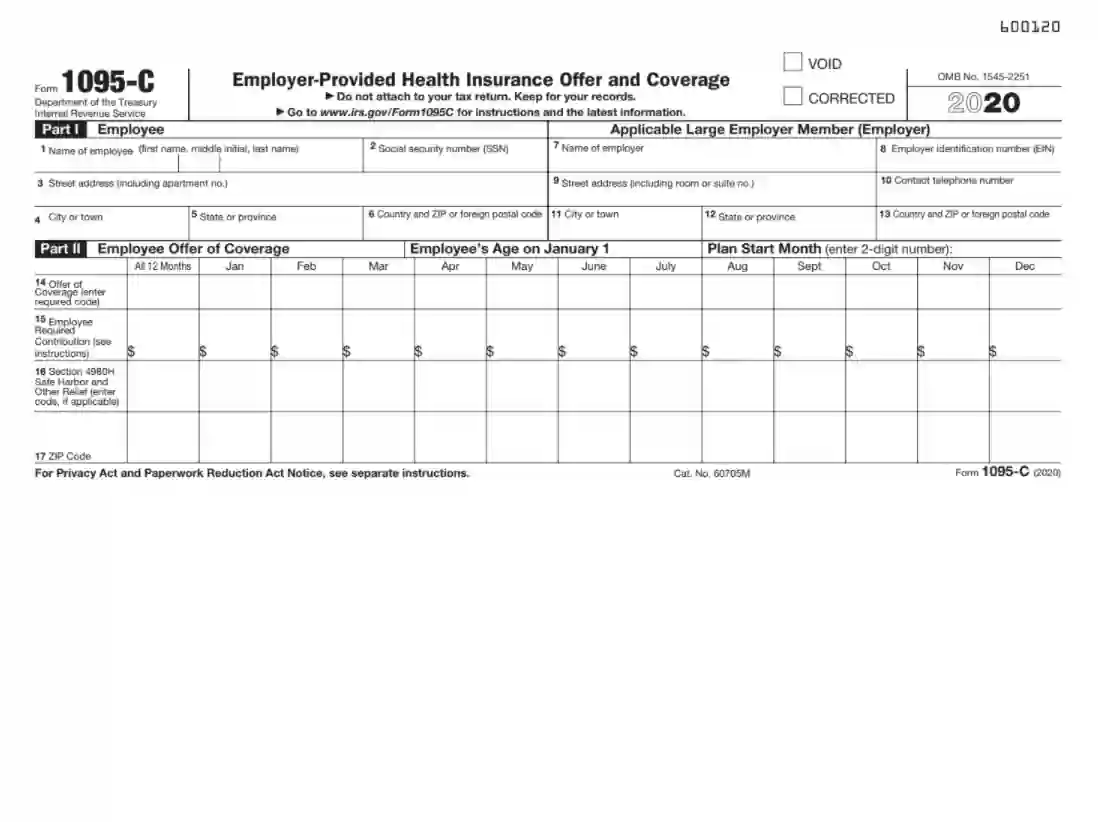

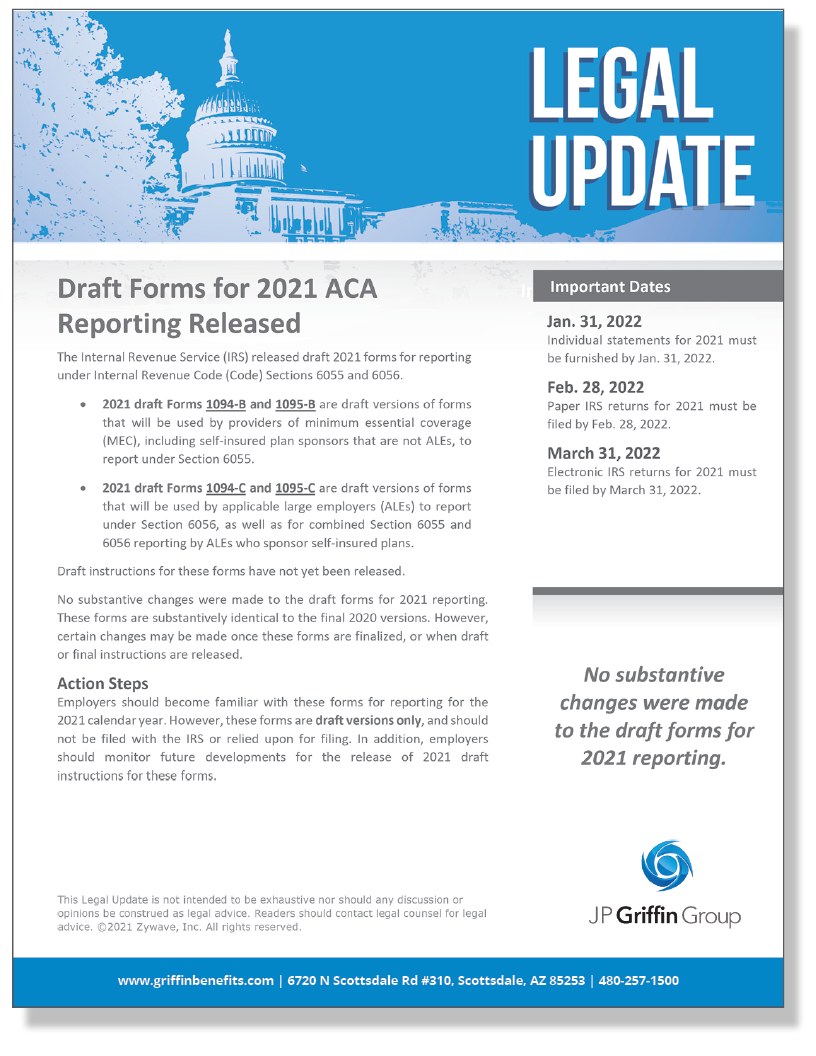

Filing Deadline for Calendar Year Affordable Care Act (ACA) reporting under Section 6055 and Section 6056 for the calendar year is due in early 21 Specifically, reporting entities must File returns with the IRS by , since Feb 28, 21, is a Sunday (or , if filing electronically);For tax year , the deadline to furnish Form 1095C to DC plan participants is , and the deadline to submit Form 1094C and 1095C to OTR is If you have any questions, please contact the authors or one of the Miller Johnson attorneys listed to the left Updated for Tax Year / 0440 AM OVERVIEW IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare

Also, the filing deadlines were not extended for Forms 1094B, 1095B, 1094C, or 1095C with the IRS, all of which must be filed by Feb 28, 21, or efiled by The term "filing" means submitting the forms to the IRS, either electronically or through mail What Happens if Deadlines are Not Met?In addition to the penalty changes, the IRS also extended the deadline for employers to provide Forms 1095C to fulltime employees According to ACA Times, here are the deadlines for filing ACA forms Paper file Forms 1094C and 1095C by The 21 ACA reporting deadlines for the Forms are now as follows Forms 1095B and 1095C Deadline to Furnish to Individuals;

An employer must file Form 1094C when filing one or more Forms 1095C for its fulltime employees Form 1095C is used to report information about each employee Note The deadline to efile Forms 1094C and 1095C is If you intend to efile your forms, please disregard the paper filing deadline Deadline for filing with the IRS in paper form (since Feb 28, 21, is a Sunday) Deadline for furnishing Forms 1095B and 1095C to individuals Deadline for filing with the IRS electronically* 1095Bs / 1095Cs due to employees 1095Bs / 1095Cs and 1094B / 1094C paper filing due to IRS ** 1095Bs / 1095Cs and 1094B / 1094C eFile due to IRS *Submit filing by 300pm CST on to guarantee compliance

Hr Compliance Updates January 21 Nulty Insurance

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

For calendar year , Forms 1094C and 1095C are required to be filed by , or , if filing electronically See Furnishing Forms 1095C to Employees for information on when Form 1095C must be furnished5 rows 1095C 1094B March 31,X 28 /Action Employers choosing to file paper Form 1094C must do so by Feb 28, to prove compliance with the Employer Shared Responsibility Mandate of the Affordable Care Act (ACA) 21 DEADLINES AND IMPORTANT DATES FOR PLAN SPONSORS

Acawise Features In 21 Employment Coding Feature

Last Call Final 30 Day Extension For Aca Reporting Forms Furnished In 21 Abd Insurance And Financial Services

The deadline to paper file forms 1094C and 1095C for the reporting year This is for employers filing less than 250 forms who elect to paper file The forms must be in the correct format (extended deadline)IRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer ACA Filing deadline for 21 Employers should know the updated ACA 1094 and 1095B/C reporting deadlines for 21 Learn MoreForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Form 1094 C And Form 1095 C B Benchmark Planning Group

For calendar year 21 Forms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information Returns TAX DEADLINES 21 For more employer and payroll related deadlines please contact our office or visit IRS Calendar 1098, 1099, 3921, 3922, 1094B, 1095B, 1094C, 1095C, and W2G This due date applies only if you file electronically If filing by paper, the due date is March 1 The due date for giving the recipient these forms willForm 1094C Filing Deadline Beginning with the 18 tax year, employers must file Form 1094C to the IRS with Form 1095C Both forms are due to the IRS by February 28 th (if paper filing) or April 01 nd (if efiling) of the year following the calendar year the return references If the regular due date falls on a Saturday, Sunday, or legal

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Instructions For Aca Reporting Released Sequoia

To the IRS each year, using IRS Forms 1094C and 1095C The deadline for filing paper versions of the forms with the IRS is (since Feb 28, 21, is a Sunday);For calendar year 21, Forms 1094C and 1095C are required to be filed by , or , if filing electronically ez1095 software can prepare, print and efile forms 1095B, 1094B, 1095C and 1094C ACA forms You are welcome to download the trial version for free, with no registration needed and no obligationNoncalendar year plans must submit within 60 days following the first day of the plan year) Submit annual notice of creditable and

2

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

The deadline to file the Forms 1094C and 1095C with the State of California is for all filers The California deadline mirrors the Federal electronic filing deadline of and is more generous than the Federal deadline of ifThe ACA deadlines for furnishing copies to employees, paper filing, or efiling to IRS are as follows You must furnish Form 1095C to your employees by The due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronicallyFor more information on efiling, see the March 31 deadline for efiling below An automatic 30day extension of time is available by filing Form 09 on or before Feb 28, 21 March 1 (For calendar year plans;

2

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

ACA reporting for employers is generally handled via IRS Forms 1094C and 1095C For more details, including the applicable ACA reporting deadlines Last Call Final 30Day Extension for ACA Reporting Forms Furnished in 21 The filing deadline for Forms 1094B, 1095B, 1094C, and 1095C with the IRS remains February 28 th, 21, if filing by paper and March 31 st, 21, if filing electronically Sections 6055 and 6056 provide the IRS with the ability to grant extensions of up to 30 days for furnishing Forms 1095B and 1095C when good cause is demonstrated ez1095 software is now available from Halfpricesoftcom for HR manager to mail out ACA Forms 1095 C, 1094 C, 1095 B & 1094 B before deadline Download trial at wwwhalfpricesoftcom ez1095 15 software is very easytouse and affordable Customers can download and print ACA forms 1095 and 1094 without learning curve

Irs Extends Employer 1095 Due Date Medben

2

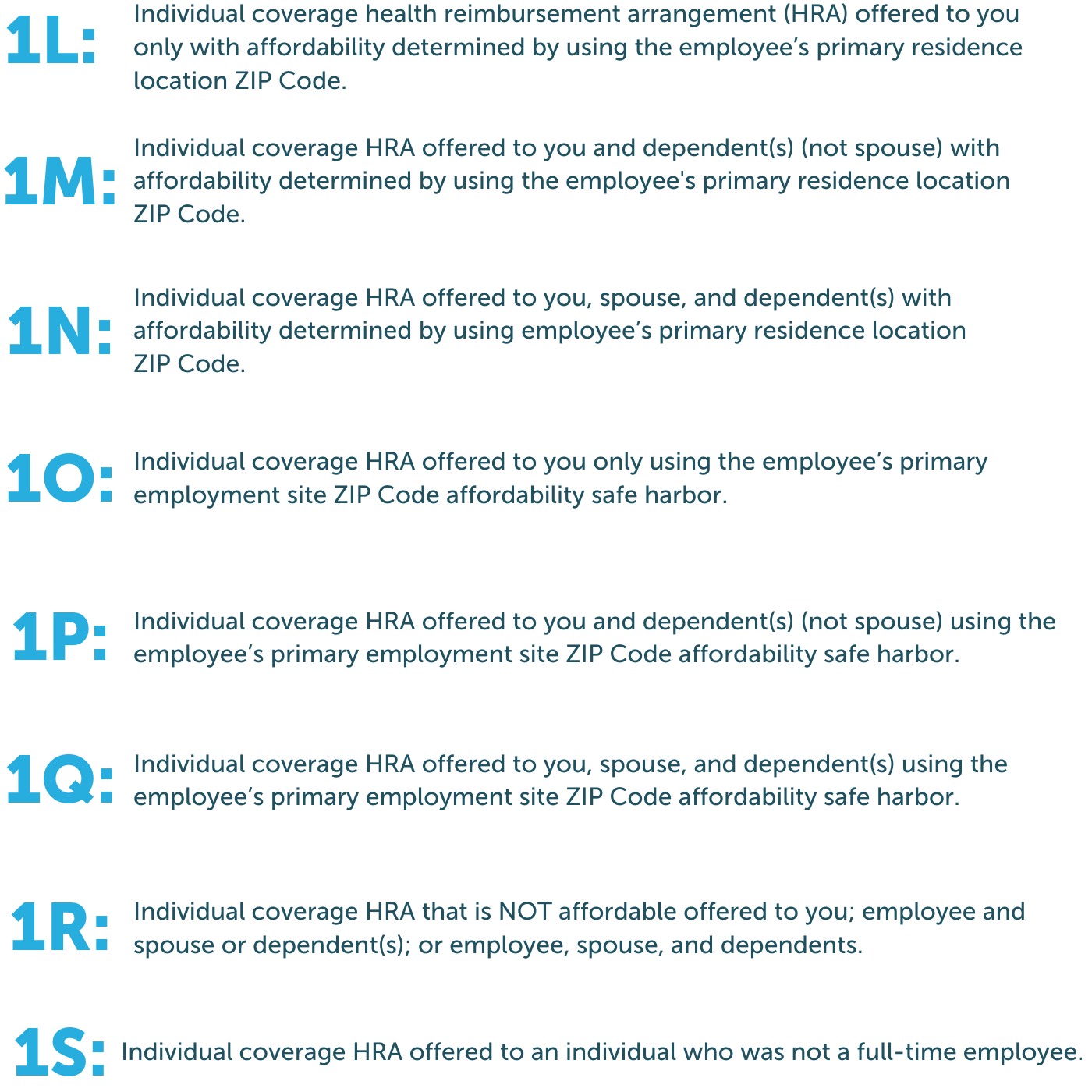

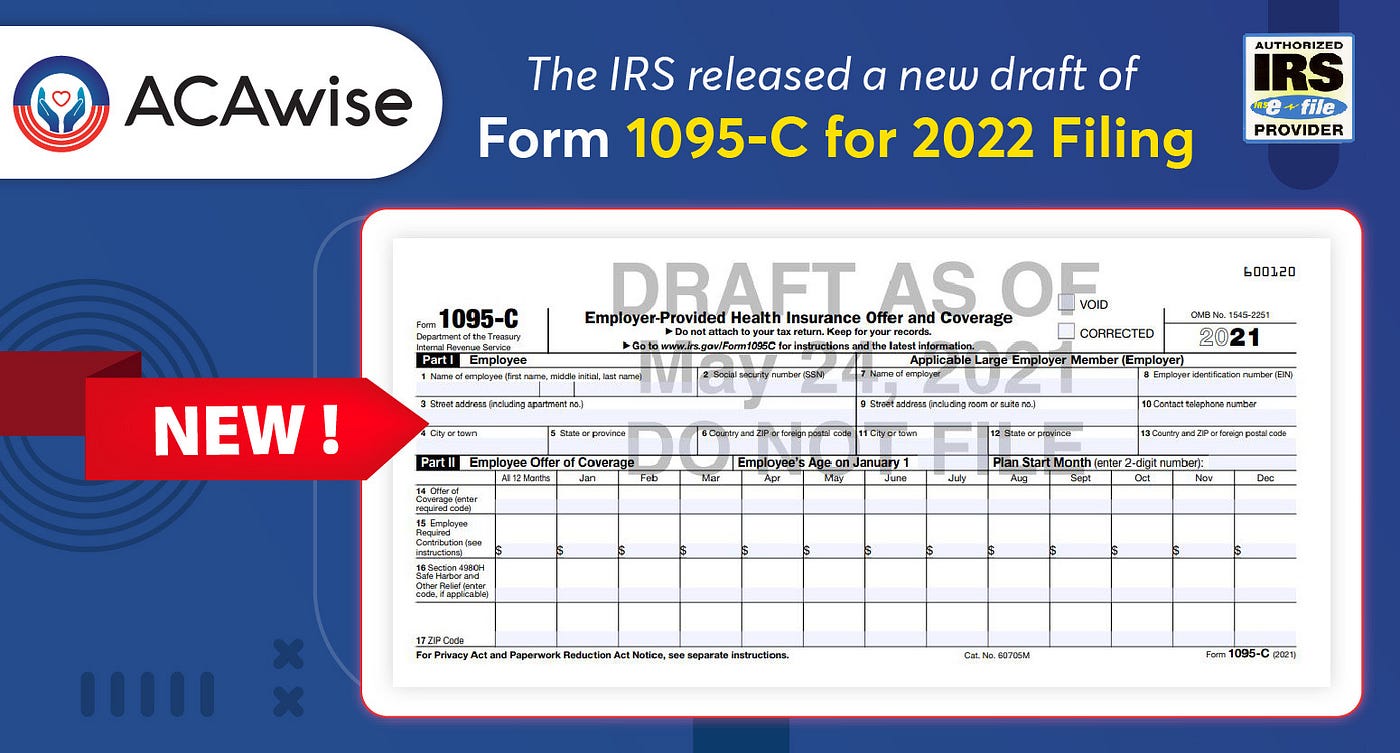

In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting document While not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs – Deadline for Submission of Information from Forms 1094B and 1094C to the IRS, if filing electronically USPS and CAPPS HR/Payroll Agencies (Central Agencies Only) The Comptroller's office will have the forms to agencies for distribution to employees on or before Feb 19, 21ACA Filing Deadlines Applicable Large Employers (ALE) are still required to report coverage for the year Form 1095C and Form 1095B statements must be provided to fulltime employees by The due date for electronically filing Forms 1094/1095B and 1094/1095c is

Employer Reporting Forms 1094 C And 1095 C Hays Companies

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Employers must electronically file the Forms 1094C and 1095C with the IRS no later than this date (As a note, for California employers, this is also the deadline for Pay Data Reporting) Failing to meet these deadlines can result in penalties under IRC 6721/6722, which the IRS is issuing through Letter 972CG If you receive one of these notices,Furnish statements to individuals by, to See Notice 76 and Extensions of time to furnish statements to recipients 1094C and 1095C, but should instead file Forms 1094B and TIP 1095B to report information for employees who enrolled in the employersponsored, selfinsured health coverage

What You Need To Know About Aca Annual Reporting Aps Payroll

Irs Extends Deadline To Provide Forms 1095 B And 1095 C

What are the 21 deadlines for filing ACA forms? In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting documentWhile not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs As in previous years, the IRS did not extend the deadline for filing 19 Forms 1094C and 1095C with the IRS (leaving the deadline to file with the IRS at , for paper filers and , for electronic filers)

2

Help Zenefits Com Documents 446 Aca Form Gen Guide 1 Pdf

is the deadline to paper file forms 1094C and 1095C with the IRS for the tax year This applies to employers with total form counts (less than 250) who can elect to paper file their ACA information filings with the IRS, is the paper filing deadline for the Tax Year IRS mandates electronic filing for those who are reporting more than 250 Forms Be aware that this extension does not apply to the 1094B and 1094C filings with the IRS The deadline for submitting these filings to the IRS will remain (since the original due date of February 28 falls on a Sunday), for paper filings and , for those filing electronically

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Education Ky Gov Districts Documents Aca 1095 generate reporting Pdf

Updated For Administrators and Employees For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically)1094c deadline 1921 Complete forms electronically using PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve forms by using a legal digital signature and share them through email, fax or print them out Save forms on your PC or mobile device Boost your efficiency with effective solution?Standard Due Date Extended Due Date Forms 1094B and 1094C (Copies of Forms 1095B/1095C) Deadline to File with IRS by Paper

Aca Software Hrdirect

Aca Reporting Requirements Aca Compliance Aps Payroll

The deadline for electronic filing is Section 6055 reporting (paper filing deadline) Employers that are not ALEs and sponsor selfinsured health plans UPDATED The deadline to report has been extended to UPDATED with additional guidance from the California Franchise Tax Board Fully insured employers whose carrier distributes Form 1095B to California plan participants satisfy their form distribution obligation under the CA Individual Mandate Completing IRS Forms 1094C and 1095C, or 1094B and 1095B (as they would to meet applicable federal requirements) Submitting these forms electronically by for tax year to the New Jersey Division of Taxation;

2

Irs Issues Draft Form 1095 C For Aca Reporting In 21

An employer subject to the employer shared responsibility provisions under section 4980H must file one or more Forms 1094C (including a Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee of the employer for any month of the calendar year The deadline for filing Forms 1094B, 1095B, 1094C or 1095C with the IRS remains , or , if filing electronically As a reminder, employers who are filing more than 250 of these reporting forms are required to file electronically The IRS has released final forms and instructions IRS Starts Processing Taxes Filing Deadline for Taxes Deadline for Extension Filers

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

– Deadline for Submission of Information from Forms 1094B and 1094C to the IRS, if filing electronically USPS and CAPPS HR/Payroll Agencies (Central Agencies Only) The Comptroller's office will have the forms to agencies for distribution to employees on or before Feb 19, 21

1094 C 19 21 Online Pdf Template

2

Www Ftb Ca Gov Forms 35c Publication Pdf

Aca Reporting Requirements For 21 By Acawise Issuu

21 Aca Reporting Requirements Aca Reporting Requirements For Form 1095 B And 1095 C

Updates To Form 1095 C For Filing In 21 Youtube

2

Www Bluechoicesc Com Sites Default Files Documents Agents Coco Aca agent flyers Aca reporting requirements flier Pdf

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Aca Reporting Software Form 1094 1095 B C Filing Services

Aca Burdened Majority Employers Minding The Spirit Of The Law

2

21 Tax Day Update Roche Legal

Pin On Acawise

Deadlines Ahead As Employers Prep For Aca Reporting In 21

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

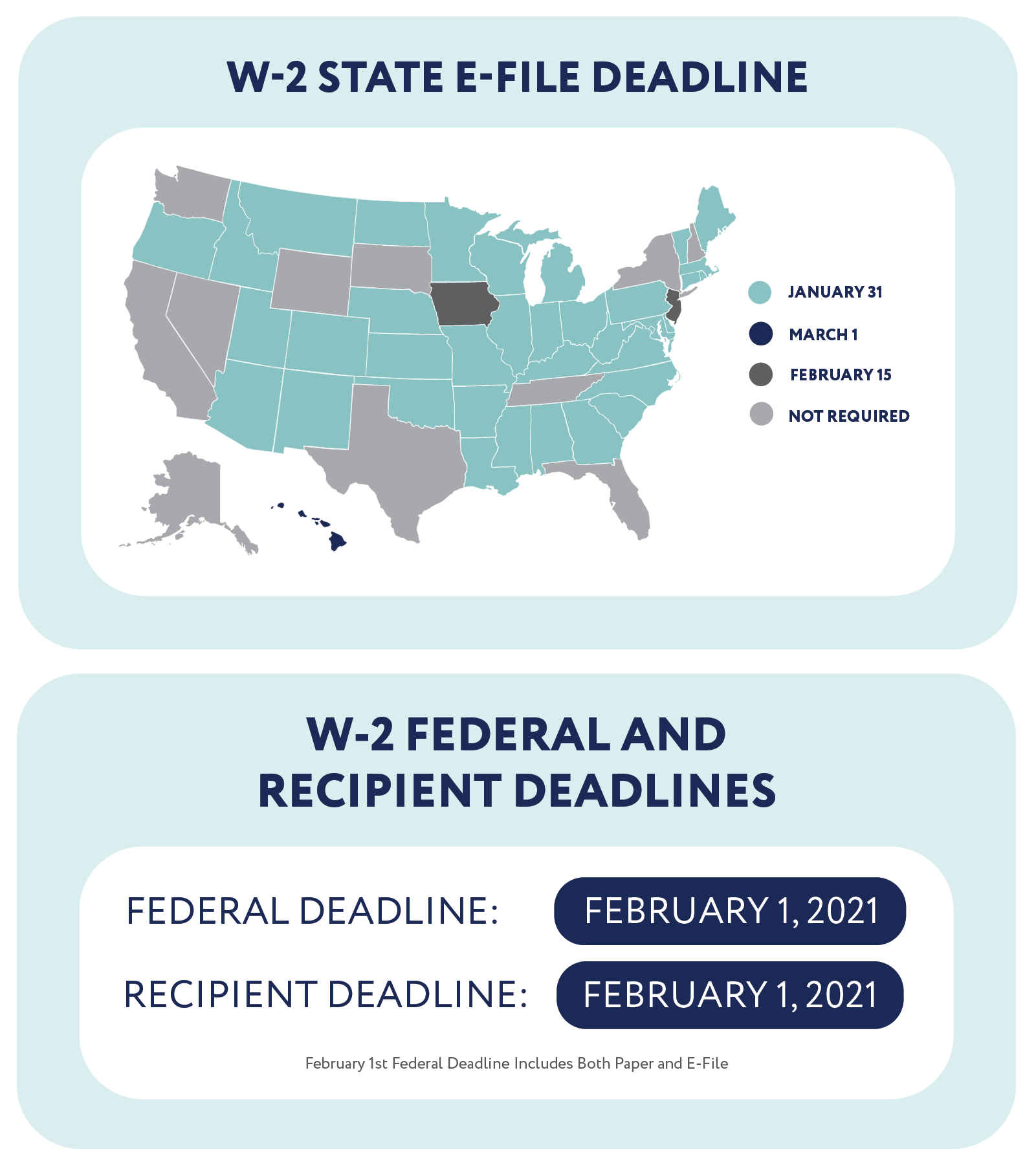

E File Deadlines For Your W 2 Forms Nelcosolutions Com

2

Bernard Health

Qritgkvszizhbm

2

Help Zenefits Com Documents 446 Aca Form Gen Guide 1 Pdf

Express Aca Forms Expressacaforms Twitter

Avoid Aca Penalties By Meeting These 21 Irs Deadlines

Irs Extends Aca Reporting Deadline Barclay Damon

2

Obamacare Tax Forms 1095 B And 1095 C 101

2

Irs Form 1095 C Fill Out Printable Pdf Forms Online

Mark These Dates For 19 Aca Reporting Update The Aca Times

Www Ceridian Com Ceridian Media Files Resources Qepacketdf Pdf

Employer Deadline To Furnish Forms 1095 B C To Plan Participants Extended To March 2 Sequoia

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

Aca 15 Reporting Requirements Doeren Mayhew

Changes In 21 Aca Reporting Health Insurance Coverage Employment Health Plan

Www Irs Gov Pub Irs Drop N 76 Pdf

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Bailey And Co

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Aca Deadlines Penalties Extension For 21 Checkmark Blog

March 31 Is The Deadline For E Filing Aca Returns With The Irs The Aca Times

7 Must Know 21 Hr Compliance Dates Workest

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Klr 21 Tax Deadlines

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

21 Aca Reporting 1094 1095 Filing Deadline

Affordable Care Act Form 1095 C Form And Software Hrdirect

Irs Reporting Under The Affordable Care Act Bkd Llp

Help Zenefits Com Documents 446 Aca Form Gen Guide 1 Pdf

Irs Provides Transition Relief For Aca Reporting Hays Companies

Irs Reporting Under The Affordable Care Act Bkd Llp

Www Adp Com Media Adp Blog Articles Pdf I R Irs Extends Form 1095 Furnishing Deadline 8066 Pdf

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Forms 1094 1095 Reporting Deadline Extended Educational Benefits

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Avairs Provides Transition Relief For Aca Reporting Pierce Group Benefits

Resource Center

2

1095 C Reporting Determining A Company S Ale Status Integrity Data

Aca Compliance Mzq Consulting

2

2

Irs Extends Deadline For Furnishing 18 Forms 1095 To Individuals And Good Faith Transition Relief Health Employment And Labor

2

The Irs Extends Aca Recipient Copy Deadline For The Tax Year Blog Acawise Aca Reporting Solution Business Rules Irs Important Dates

1

Form 1095 C H R Block

Irs Deadline Relief Available To Victims Of Federally Declared Natural Disasters Hays Companies

Deadlines For 1095 Cs 1095 Bs In 21 Bernieportal

Irs Ssa Filing Penalties For Nelcosolutions Com

Updated Guidance Released On Employer Reporting For The California Individual Mandate Sequoia

0 件のコメント:

コメントを投稿